Nate Bruce, Farm Business Management Specialist, nsbruce@udel.edu

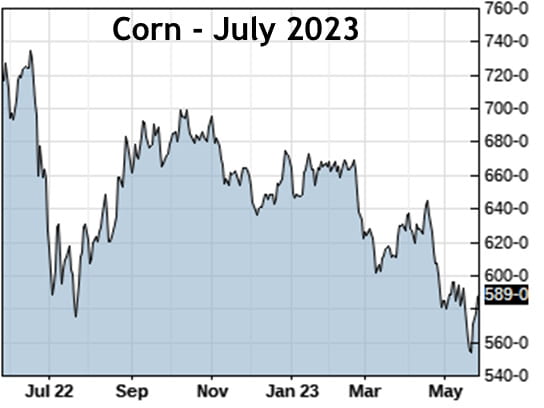

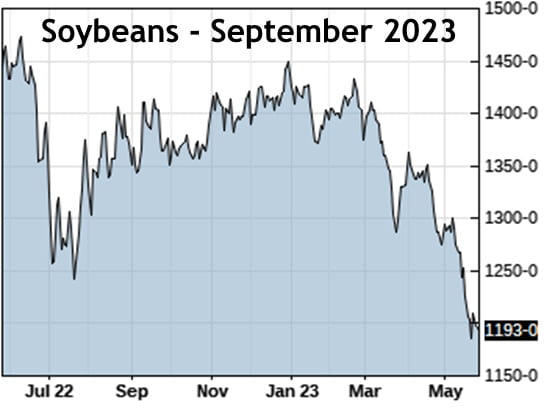

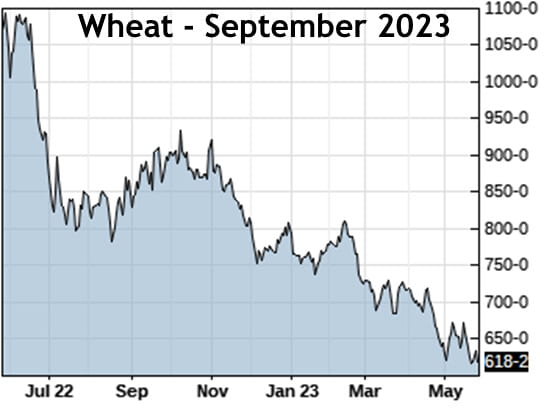

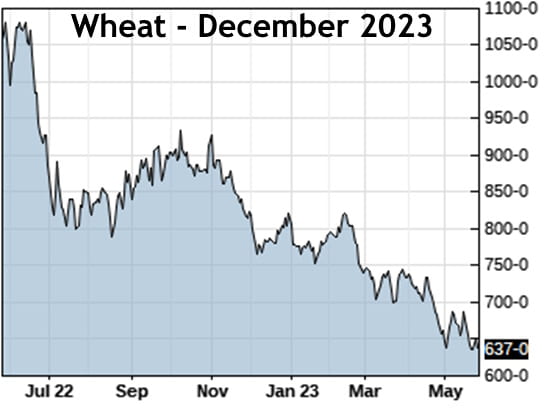

It was not long ago; corn prices were in the ($6.00/bushel) range. Bearish news such as China cancelling imports, and the Black Sea Grain Corridor continued to negatively impact corn prices over the course of the month, driving them into retreat. National corn planting progress has been well ahead of schedule, adding to declining prices. Soybean prices have also been in retreat over the course of the month. Sales for 2022/23 remained well below the USDA projected pace, and the 2023/24 season is off to a slow start. Soybean exports have been crippled due to increased competition from South America. As harvest season approaches, wheat prices have been highly volatile over the course of the past month. Crop conditions in major wheat growing areas have been extremely poor, from excessive drought, to heat issues. Coupled with the Black Sea Grain Corridor, wheat prices have been a mixed bag this past month.

The May USDA World Agriculture Supply and Demand Estimates Report (WASDE) 2023/24 outlook for corn is greater exports, and domestic use, larger production, and higher ending stocks. 2023/24 US corn ending stocks are estimated at 2,222 million bushels. This is 805 million bushels higher than last year’s estimate. If this estimate comes to fruition, this will be the highest ending stocks since “2016/17”. The corn season-average farm price per bushel is estimated to be $4.80, down $1.80 from 2022/23. The 2023/24 soybean outlook is for lower exports compared to 2023/24 due to South American competition, higher supplies, crush, and ending stocks. The USDA WASDE report estimated US soybean ending stocks at 335 million bushels. This is 120 million bushels higher than last year’s estimate. The soybean average farm price per bushel is estimated to be $12.10, down $2.10 from last years estimate. The 2023/24 outlook for wheat is increased domestic use, smaller stocks, and reduced supplies and exports. The USDA WASDE report estimated wheat ending stocks at 556 million bushels, down from last years estimate of 598 million bushels. The projected wheat season average farm price is estimated to be $8.00 per bushel, down $0.85 from last year.

In international grain market news, the United Nations brokered Black Sea grain deal was extended for two months to ease food supplies worldwide. The deal allows for wartime exports of food and fertilizers from the Ukrainian ports of Odessa, Chornomorsk, and Pivdennyi. The Ukrainian government has accused Russia in recent weeks of blocking exports out of the port of Pivdennyi. This has added tension to an already difficult agreement. During the month of May, Chinese buyers cancelled large imports of United States corn imports due to weak demand and cheaper supplies from Brazil. Brazil is expected to become the world’s top corn exporter this year. United States corn is less competitive in the export market with supplies from Brazil being $30/ton cheaper. Conab, “Brazil’s” food supply and statistics agency, raised its forecast for Brazilian soybean and corn production. Conab predicted Brazilian farmers will harvest a record 154.8 million tons of soybeans, which is an increase of 23.3% above the last year, and a record 125.5 million tons of corn, 11% above last year.