Nate Bruce, Farm Business Management Specialist, nsbruce@udel.edu

On Tuesday, the consumer price index (CPI) or inflation rate for August was announced at 8.3%. Inflation was higher than economists expected as it only fell from 8.5% in July, despite lower crude prices. Prior to 2022, the last time the inflation rate exceeded 8.0% was in 1982. With the inflation rate remaining high, some may wonder how inflation impacts grain prices.

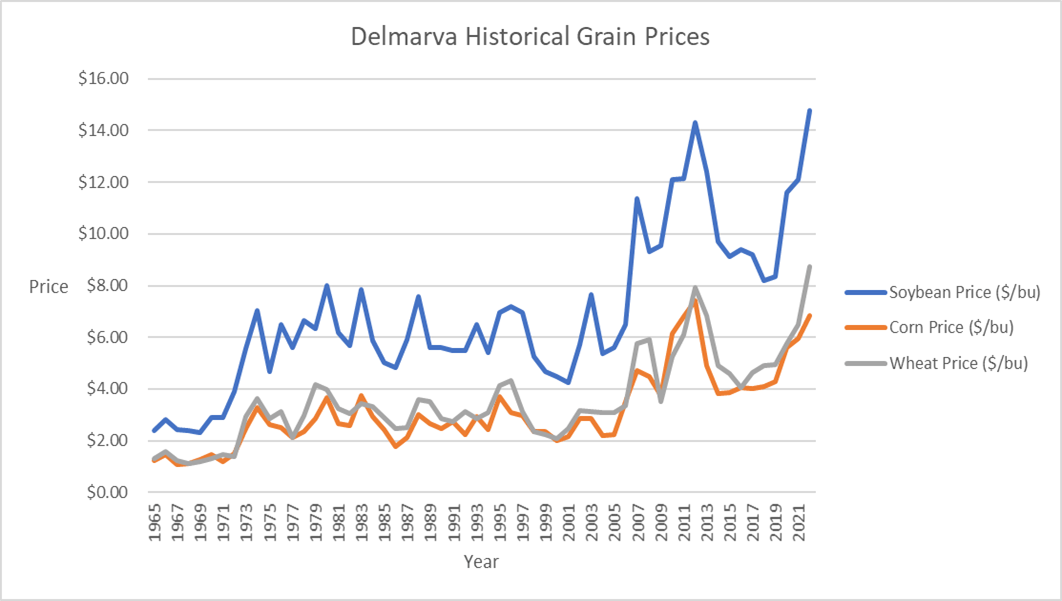

Below is a graph that shows historical grain prices on the Delmarva peninsula from 1965 to the current day. Increased export and import demand can be attributed to the increase in grain prices during the early 1970s. Growth in major export markets such as China and increased ethanol usage can be attributed to the grain price increase in 2006. All three major grain crops on the Delmarva peninsula are highly correlated because the same demand factors influence all three crops. In addition, similar acreage is involved in production as well.

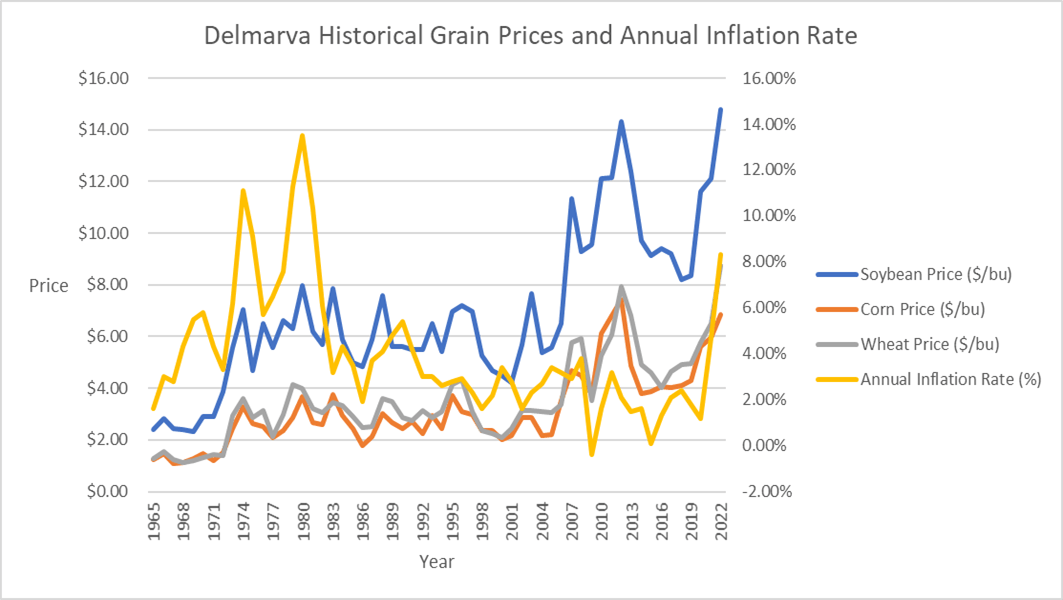

Below is a similar graph that shows the inflation rate charted with the price of all three major Delmarva commodity crops.

When long run grain price changes occurred in the early 1970s, it was accompanied by high inflation with the rate being well above 5%. The long run price change in 2006 had no association with inflation. Historically, there is not a clear relationship between inflation and long-run commodity price changes. The recent higher grain prices are linked more to export demand than inflation, particularly because of both the Ukraine-Russia War and strong import demand from China. If either of these factors end, prices could invariably decrease, regardless of the inflation rate. A slightly positive relationship exists between commodity prices and the inflation rate, but it is not strong. There have been periods where the inflation rate was high, and commodity prices were low, as occurred in 1999. The opposite was seen during 2011 and 2012 when commodity prices reached all-time highs, and the inflation rate was low.