Nate Bruce, Farm Business Management Specialist, nsbruce@udel.edu

Inflation has been on the rise over the last year and shows no signs of stopping anytime soon. Just this Wednesday, the Federal Reserve raised its key short-term interest rate by a half percentage point. This is the largest interest rate hike since 2000 and could be a signal of more to come over the course of the year to curtail inflation. General inflation has had a drastic impact on farm input costs, in addition to many other factors (Covid 19, Ukraine-Russia, supply chain issues, etc.).

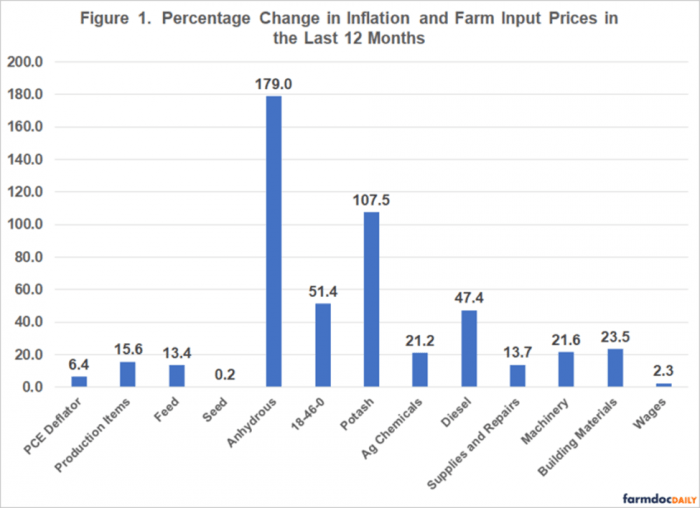

An interesting study done by the University of Illinois recently looked at the general price index of farm inputs and their relationship to inflation. They found that agricultural inputs rose at a rate of 15.6% or more than double the general inflation rate, with input price changes for fertilizer products and energy being particularly high. Diesel prices increased by 47% in the last 12 months and fertilizer prices ranged from a 51% increase for diammonium phosphate, to a high of 179% for anhydrous ammonia. The study found the only input prices that increased at a rate lower of the general inflation rate were seeds and wages. It is critical to remember that each farm input used in production agriculture has its own sets of supply and demand functions as well. For example, natural gas is a major input required to produce both ammonia and urea fertilizers. Therefore, certain agricultural input prices have increased at rates far quicker than others (particularly fertilizer products). Below are the percentage changes in farm input prices over the last 12 months from the Illinois study. The PCE deflator or Personal Consumption Expenditure Deflator is simply a measure of inflation based on changes in personal consumption.

Despite relatively high commodity prices, producer sentiment that input prices will continue to rise over the course of next year remains high. A University of Purdue study found 36% of survey respondents said they expect input prices to rise 10% or more from 2022 to 2023, with 21% expecting input prices to rise 20% or greater. It is impossible to know when and if things will become normal within the year or even the next couple of years. To make sure your farming operation is financially sound to withstand inflation, you need to be aware of all risks and pay attention to the amount of loan borrowing. It is also imperative to review budgets, and particularly understand the return value of all input costs on their operation.

The University of Illinois study:

https://farmdocdaily.illinois.edu/2022/04/trends-in-general-inflation-and-farm-input-prices.html

The University of Purdue study:

https://www.purdue.edu/newsroom/releases/2022/Q2/producer-sentiment-improves-with-strengthened-commodity-prices,-but-high-cost-inflation-worries-farmers.html

Percent change in inflation and farm prices in the last 12 months.